The Newest E-bike Tax Credit and How To Get $1500 Off

What is the US Electric Bike Tax Credit Act of 2023?

The Electric Bicycle Incentive Kickstart for the Environment Act or the E-BIKE Act is a bill that was reintroduced in 2023 by Democratic lawmakers in the USA. It was proposed by Sen. Schatz, Brian. It aims to encourage more people to use electric bikes as a clean and healthy mode of transportation by offering a federal tax credit for e-bike purchases.

Bill link: https://www.congress.gov/bill/117th-congress/senate-bill/2420/text

Which e-bikes qualified for tax credits?

In General, a qualified electric bicycle means a two or three-wheeled bike. And several conditions need to be met.

1. The E-bike is a class 1 electric bike, a class 2 electric bike, or a class 3 electric bike. (Distinguish class 1,2,3 electric bikes)

2. The bike is equipped with pedals.

3. The bike is equipped with a saddle or seat for the rider.

4. The bike is equipped with an electric motor of fewer than 750 watts.

5. The original use of which commences with the taxpayer.

6. The bike is acquired for use by the taxpayer in the United States and not for lease or resale.

7. The bike is not the property of a character subject to an allowance for depreciation or amortization in the hands of the taxpayer.

8. The total amount paid for the electric bike does not exceed $8,000.

Note: If you are unsure whether your electric bicycle qualifies for the tax credit, please consult the tax professional.

How much is the tax credit for the Electric Bike Tax Act?

If passed into law, it would provide buyers of brand-new electric bikes with a tax credit of up to $1,500, or 30% of the bike's cost. The e-bike must be less than $8,000 in price to be qualified for the tax credit.

The bill sets buyers' incomes caps at $150,000 for single filers, $225,000 for heads of household, and $300,000 for joint filers to make the subsidy accessible to low-income persons.

For joint couples who buy two e-bikes, each can get one or two credits every three years.

Which states apply to the Electric Bike Tax Act?

The bill applies to all states and territories of the USA, as long as the e-bike is purchased from a registered dealer or manufacturer. To claim the tax credit, the taxpayer must fill out a form and attach a receipt or invoice of the e-bike purchase. The tax credit can reduce the taxpayer’s income tax liability or receive a refund if the credit exceeds the liability.

What is the purpose of this bill?

The purpose of the bill is to promote the use of e-bikes as a more environmentally friendly mode of transportation. It is thought to be a useful strategy for encouraging the ownership of e-bikes, particularly among low-income individuals who want to lessen their carbon footprint.

Are there other e-bike subsidy programs to participate in?

Many towns and state governments have also started to create local incentive schemes when the prior federal e-bike incentives stopped. A list of US state-subsidy programs is shown below.

California offers up to $1,000 for regular e-bikes and up to $1,750 for cargo or adaptive e-bikes.

Contra Costa County can claim up to $300 in savings on a new e-bike.

Contra Costa County is age 18, meets income requirements, and lives in designated counties to receive $500 for the purchase of an e-bike.

City of Redding, CA who meet income guidelines and enroll in the Residential Energy Rebate program will receive up to $1,150 in vouchers.

Avon, CO Receive up to $200 in credit on new e-bikes worth $1,000 or more.

Denver saves up to $1,700 on e-bikes by applying.

Connecticut is offering a $500 rebate for electric bikes that cost $3,000 or less.

Hawaii is offering residents a 20% rebate on e-bikes up to $500.

Massachusetts offers rebates of $500 to $750 for e-bikes depending on residents’ income status.

The New York State program will offer a 50 percent rebate of up to $1,100 on the purchase of an electric bike.

Oklahoma is offering a $200 tax credit on qualifying new e-bike purchases.

Nashville has a base rebate of up to $300 for e-bikes and a maximum rebate of $500 for cargo e-bikes. E-bikes or cargo e-bikes qualify for an income-qualified rebate of up to $1,400.

Washington, D.C. offers local residents a discount of 75% or up to $1,200 off the cost of a bike or 75% off the cost of a bike.

In Conclusion

Now that you have read more about the bike tax credit, you should know if you are eligible, so what are you waiting for, pick the right e-bike for you now.

E-bikes are ideal for traveling around and exploring because they are adaptable and can manage a variety of circumstances. Believe me, for short trips and commutes, there are no more environmentally friendly and comfortable means of transportation than electric bikes. With your new e-bike, explore a variety of terrain and places that you might not have been able to visit before. Saving you money on the tax credit.

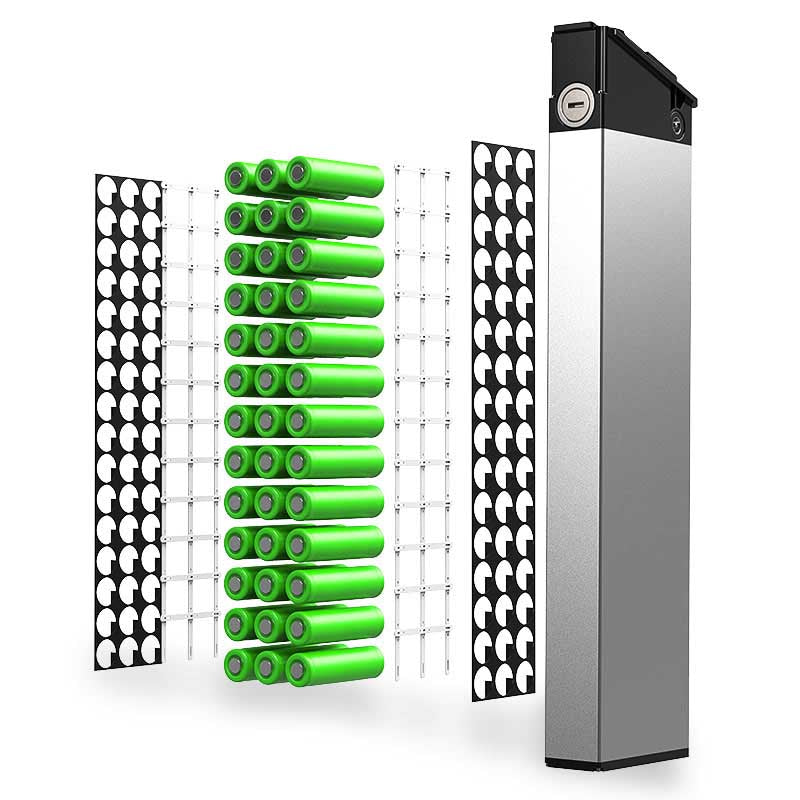

Most importantly, getting an electric bike is a step towards green living, now that the environment is heavily polluted, support clean energy, and do your part. All Euybike electric bike collections meet the requirements of the bill. So don't hesitate, to check out the e-bikes and take advantage of this fantastic opportunity!

Leave a comment